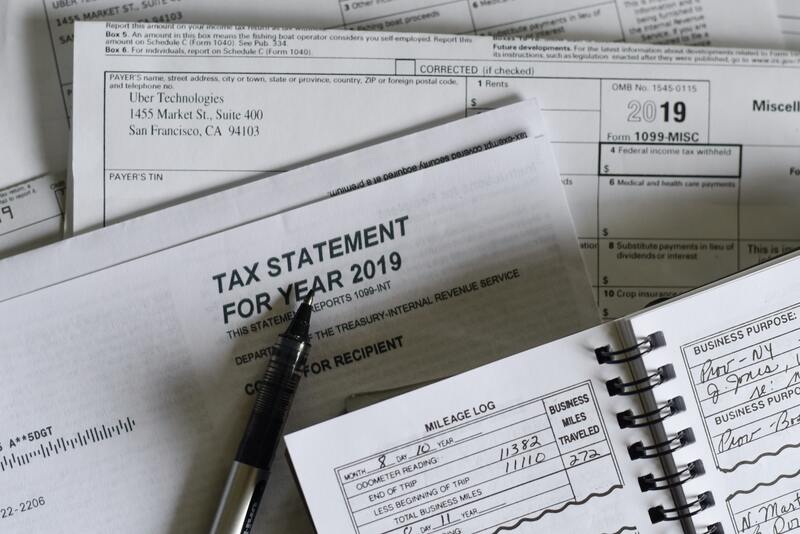

Discovering Financial Ease

We know running your business is a full time job, requiring detail and expertise. Our bookkeepers are experienced and knowledgeable in all things financial. Whether you are looking for bookkeeping services, payroll, or tax preparation we have a team ready for your specific business' needs.

|

Like us on Facebook for our latest Tips on Bookkeeping you can practice everyday!

Also be on the lookout for our contests for free coffee! |

|